b&o tax states

Washington has a gross receipts tax. Business and Occupation Tax.

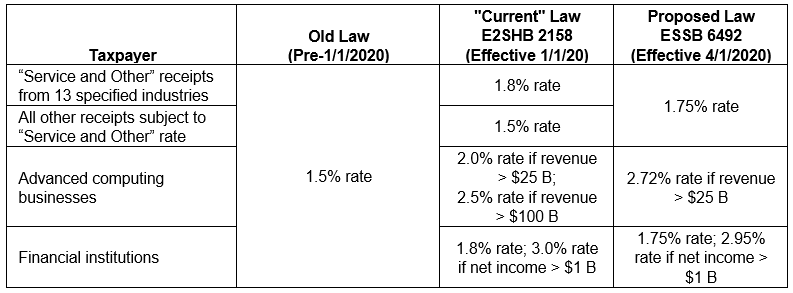

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

While the claim that we dont have an income tax is technically true you pay the BO tax on your gross income.

. No deduction is allowed for labor. Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level. Washingtons BO tax is calculated on the gross income from activities.

Washington Business Occupation Tax. It applies to the gross income of the business. Washington has a state sales tax rate of 65 which is.

See also Wholesaling of Solar Energy on this page. As an incorporated city one way the City of Bainbridge Island raises revenue is through its. Submit exemption Form MI-W4 to your employer if you work.

It is a type of gross receipts tax because it is levied on gross income rather than net income. The Washington State Supreme Court today September 30 2021 upheld the constitutionality of the states business and occupation BO tax surcharge imposed on certain. There are multiple states with gross receipts tax.

Washington state doesnt have income tax like most states but business owners do need to pay Business and Occupation BO tax and this is usually on a state and city level. The BO tax for labor materials taxes or other costs of doing business. The Washington BO tax is a gross receipts tax applied on property and services.

The Washington BO tax is a gross receipts tax applied on property and services sourced to. Michigan has reciprocal agreements with Illinois Indiana Kentucky Minnesota Ohio and Wisconsin. The business and occupation tax often abbreviated as BO tax or BO tax is a type of tax levied by the US.

While deductions are not permitted for labor materials or other overhead expenses the State of Washi. The BO tax is a gross receipts tax assessed against an entity for conducting business in Washington. Businesses receive a classification with a corresponding tax rate.

Additional BO tax imposed on financial institutions. States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky. Business registration is done through the State of Washington Business Licensing Service.

Washington unlike many other states does not have an income tax. The tax amount is based on the value of the manufactured products or by-products. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing.

The relationship between the state BO tax and the local BO taxes is similar at least in concept to the sales tax. 32 rows B. It is measured on the value of products gross proceeds of sale or gross income of the business.

The state BO tax is a gross receipts tax. A Washington State superior court granted summary judgment for banking associations holding that the. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates.

The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. Extracting Timber Extracting for Hire Timber003424. Delaware Nevada Ohio Oregon Tennessee Texas and Washington.

Slaughtering Breaking and Processing Perishable Meat. Heres how the state BO works. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad.

Delaware Nevada Ohio Oregon Tennessee Texas and Washington. Business owners should be aware of the. The BO tax rate is 0275 percent.

A one-time 4000 city. The Washington BO tax is a gross receipts tax applied on property and services sourced to Washington most comparable to the Ohio or Oregon Corporate Activity Tax CAT. Extracting Extracting for Hire00484.

Both Washington and Tacomas BO tax are calculated on the gross income from activities. They then apply that rate to their gross receipts and cut Washington a check. Requires the business to file an Annual Tax Performance Report.

The State of Washington unlike many other states does not have an income tax. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts.

Aviation Industry Boeing Everett Factory Boeing

747 8i Crane Move Into Final Body Join Fbj Boeing 747 Jet Engine Boeing

B Amp O Tax Guide City Of Bellevue

World S Largest Airplane Photographic Print Allposters Com In 2021 Boeing 747 Boeing World

B Amp O Tax Return City Of Bellevue

Business And Occupation B O Tax Washington State And City Of Bellingham

Changes To Washington S B O Tax Economic Nexus Standard And Use Tax Notice And Reporting The Cpa Journal

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Boeing 39 S Jumbo Milestone The 1 500th 747 Passenger Aircraft Boeing Boeing 747

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Model Trains

B O Tax Annual Report To Wa Dor Seattle Business Apothecary Resource Center For Self Employed Women

Why Our B O Tax Is Unfair R Seattlewa